In every shipment, there are always two parties: buyer and seller. When a buyer purchases goods from a seller in a different country, the seller has to find a way to send their product to the buyer. However, who pays for the international shipping and who takes the risks involved is what can sometimes be a challenge to figure out.

Not if you’re using incoterms, that is.

Incoterms are a set of universally acknowledged freight agreements that clearly state what the buyer is responsible for and what the seller is responsible for.

A simple definition of an incoterm according to export.gov is as follows: “Incoterms are a set of rules which define the responsibilities of sellers and buyers for the delivery of goods under sales contracts. They are published by the International Chamber of Commerce (ICC) and are widely used in commercial transactions” (“Know Your Incoterms”).

There are eleven different incoterms, and each one is for a unique buyer/seller arrangement. Some are similar, and others are quite different. Nevertheless, they all make the shipping process so much simpler by explicitly defining the obligations of both parties. Below is a list of the incoterms used in the world of import/export and what they stand for:

- CFR (“Cost and Freight)

- CIF (“Cost, Insurance, Freight”)

- CIP (“Carriage and Insurance Paid to”)

- CPT (“Carriage Paid to”)

- DAP (“Delivered at Place”)

- DAT (“Delivered at Terminal”)

- DDP (“Delivered Duty Paid”)

- EXW (“Ex Works”)

- FAS (“Free Alongside Ship”)

- FCA (“Free Carrier”)

- FOB (“Free on Board”)

Each incoterm states a different buyer/seller agreement, which makes the shipping process so much simpler for both parties involved. The details of each incoterm are never the same, and a brief overview of each term is listed below:

- CFR (“Cost and Freight”)

CFR is a simple incoterm that simply means what it says: cost and freight. As the seller, one would only have to pay for the cost of shipping the cargo from their facility to the port in the buyer’s country. “In Cost and Freight, the seller/exporter/manufacturer clears the goods for export and is responsible for delivering the goods past the ship’s rail at the port of shipment (not destination). The seller is also responsible for paying for the costs associated with transport of the goods to the named port of destination.” (Hinkelman, 342). It is important to also note that the seller is not responsible for insurance (if desired), or delivering the freight to the buyer’s door. It is the buyer’s responsibility to arrange any insurance and/or the door delivery. “…once the goods pass the ship’s rail at the port of shipment, the buyer assumes responsibility for risk of loss or damage as well as any additional transport costs” (Hinkelman, 342).

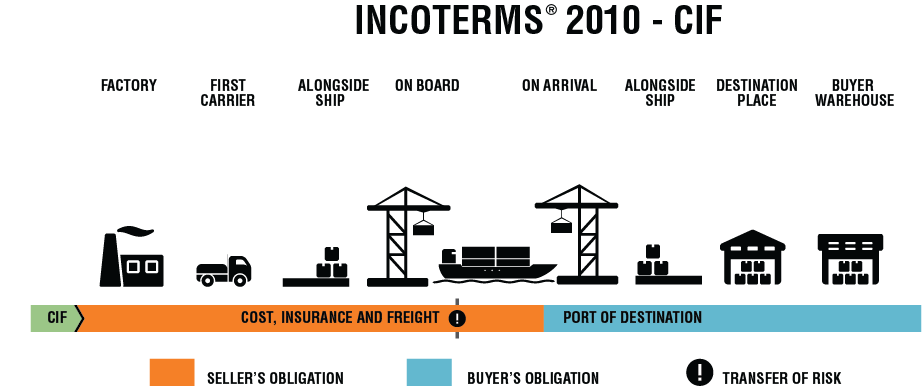

- CIF (“Cost, Insurance, Freight”)

CIF is much the same as CFR, with the added “insurance.” In CIF, the seller is responsible for all of the same as CFR with the addition of insurance. If insurance is required, the seller is responsible for arranging the insurance. “The seller is also responsible for procuring and paying for marine insurance in the buyer’s name for the shipment” (Hinkelman, 344). The buyer is responsible for any damage or loss that comes to the cargo, since the insurance was arranged by the seller in the buyer’s name. “…once the goods pass the ship’s rail at the port of shipment, the buyer assumes responsibility for risk of loss or damage as well as any additional transport costs” (Hinkelman, 344).

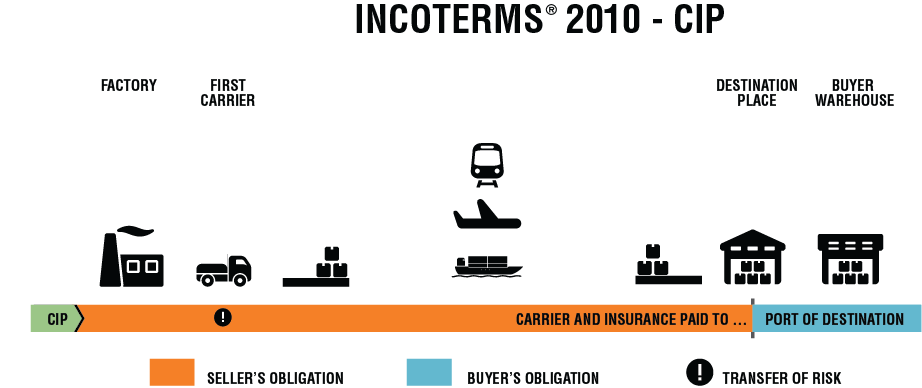

- CIP (“Carriage & Insurance Paid To”)

In CIP, the seller is responsible for a large chunk of the expense while the buyer is responsible for a large chunk of risk. The seller must supply the commercial export documents, packaging, export licenses, export customs, pick-up of cargo, loading charges, delivery at agreed place of destination, a proof of delivery, and insurance. The seller pays for the freight to be delivered to a warehouse in the buyer’s country. The buyer is responsible for customs clearance, import duties or applicable licenses, and the cost of a pre-shipment inspection. The risk transfers over to the buyer once the cargo delivers to the warehouse/loading terminal/container yard. Once the cargo arrives at this location, all damages/issues become the buyer’s problem (“CIP”)

- CPT (“Cost Paid to”)

CPT is much similar to the incoterm CIP, except in CPT, the buyer is responsible for insurance.

- DAP (“Delivered at Place”)

DAP is a shipment term used frequently in logistics, particularly by personal effects clients. In DAP, the seller is responsible for the entire transport job: all the way up until the cargo is delivered and unloaded at the buyer’s location. The seller covers risk, freight, destination terminal handling, and delivery to the buyer’s location. There is no obligation for insurance, and it can go unpaid by both parties. Risk transfers from buyer to seller once the cargo has arrived at the agreed place of destination. However, the buyer is still required to pay for import customs clearance, duties, and any applicable taxes involved (“DAP”).

- DAT (“Delivered at Terminal”)

Like the previous D-term, DAT is virtually the same as DAP, except the seller does not pay for delivery to the destination place, but at a destination terminal (at the port, for example). The goods must be unloaded there by the seller, and it is the buyer’s responsibility to retrieve the goods and deliver it to their warehouse (“DAT”).

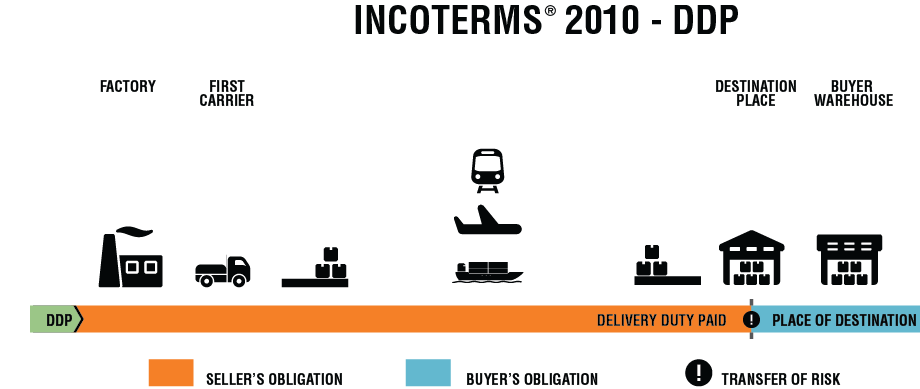

- DDP (“Delivery Duty Paid”)

Another D-term, DDP varies much more from the ways in which DAP and DAT operate. DDP adds tremendously to the seller’s responsibility, as is implied in the name “delivery duty paid.” The seller is not only responsible for the transportation of the goods to the place of delivery, but is also required to pay for customs clearance, any applicable duties, taxes, VAT, etc. This is the greatest risk for the seller. The risk only transfers to the buyer when the cargo arrives at the buyer’s premises for unloading (“DDP”).

- EXW (“Ex works”)

This incoterm is basically a buyer-pay-all agreement. The only thing the seller is obligated to do is package the cargo for export and supply it at a set destination so the buyer can arrange a pick up. It is also important to note (emphasis added), “Either the seller does not load the goods on collecting vehicles and does not clear them for export, or if the seller does load the goods, he does so at buyer’s risk and cost. If the parties agree that the seller should be responsible for the loading of the goods on departure and to bear the risk and all costs of such loading, this must be made clear by adding explicit wording to this effect in the contract of sale” (“EXW”).

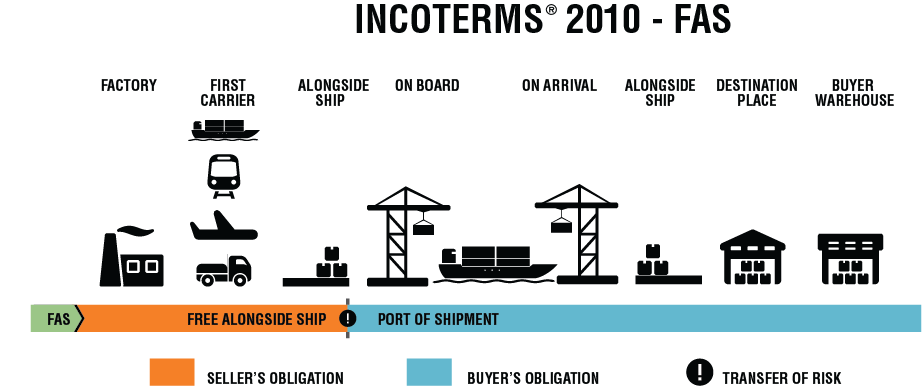

- FAS (“Free Alongisde Ship”) ~ Only applicable for ocean shipments

This incoterm can only be used for ocean shipments, and it is usually for OOG (out of gauge) cargo. OOG is cargo that is too large to fit into a container. However, FAS is not OOG exclusive, and it can be used for non-OOG cargo as well. The responsibilities of the buyer and seller are much different from that of previously discussed incoterms. The only tasks the buyer is responsible for are the delivery of the goods to the port of loading. The cargo must be delivered to the port of loading with applicable paperwork for export. This is where the risk and cost transfers to the buyer. After the goods are delivered to the port of loading, the buyer is responsible for the risk and the remainder of the costs required to get it to the intended destination (“FAS”).

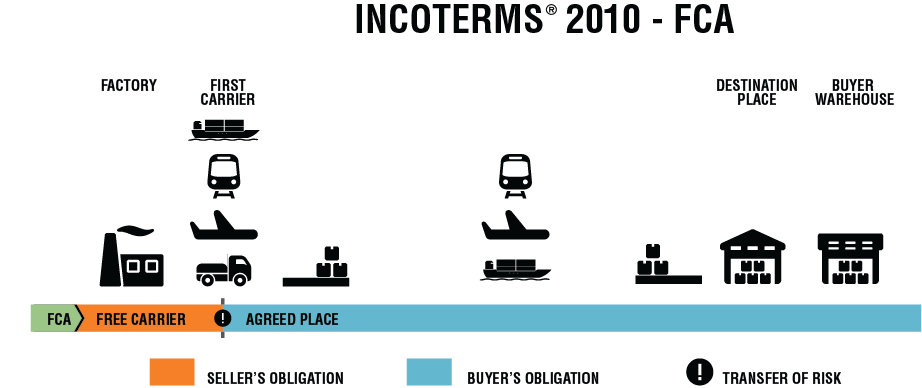

- FCA (“Free Carrier”)

FCA is exactly the same as FAS, except the risk and costs transfers from seller to the buyer earlier: it transfers at the delivery to the first carrier. For example, if the cargo needs to be delivered to a carrier’s warehouse and from there it will be taken to the port for loading, then the seller will pay for the delivery to that warehouse (and will carry the risk up until that point). However, once it is delivered there, the buyer takes the risk and the cost to load the cargo and deliver it to the intended destination (“FCA”).

- FOB (“Free on board”) ~ Only applicable for ocean shipments

This is, by far, one of the most common incoterms and one of the easiest to remember. Freight on board, as the abbreviation suggests, is the incoterm that transfers risk from seller to buyer when the cargo has been successfully loaded onto the vessel and the vessel has sailed. Insurance is not required, but if it is requested by the buyer, then it is the seller’s responsibility to insure the cargo (“FOB”).

Incoterms are the pulse driving every international shipment. They define terms of agreement, settle any argument, and easily further the shipping process. Defining everyone’s responsibilities, incoterms create cooperative business transactions that demand everyone does their part. It’s a clear, defined, and internationally recognized system that has been governing the ins and outs of global trade since they were created in 1936.

We hope this has been a helpful resource to aid you in your commercial prospects!

If you would like to request a quote for international freight you may be interested in shipping, please click HERE to be redirected to our quote page.

Cheers,

The Veritas Team